Stocks Fell Again as Fed Signaled It Could End Support

The likelihood that the Federal Reserve will hasten the reduction of its support for the economy — just as a worrying new variant of the coronavirus has begun to spread — sent a shudder through Wall Street on Tuesday, driving down stocks as investors suddenly face growing uncertainty.

The Federal Reserve chair, Jerome H. Powell, told a Senate committee that inflation was likely to persist well into next year and that the Fed would consider tapering off its purchases of government bonds “perhaps a few months sooner” than previously expected.

The Fed’s bond-buying program has been a crucial factor in the swift rise of stocks since the start of the pandemic — the S&P 500 index has more than doubled since March 2020 — and the market’s response to Mr. Powell’s comments was immediate. Stocks, which had already opened lower amid growing concern about the Omicron variant, tumbled further after Mr. Powell spoke and closed down 1.9 percent, pushing the benchmark index negative for the month.

“I think it’s a major moment,” said Nathan Koppikar, a portfolio manager at the San Francisco hedge fund Orso Partners, which often places bets that certain stocks will fall. “The Fed is finally sort of putting their stake in the ground and saying that the bubble has gone on long enough.”

As the S&P 500 struck bottom in March 2020, the Fed was restarting the type of money-printing program it put in place in the aftermath of the financial crisis of 2008 known as quantitative easing. It allowed the central bank to pump trillions of dollars into the financial system by purchasing assets such as Treasury bonds with newly created dollars — a key source of momentum for the seemingly relentless rally in share prices.

That program was never going to last forever, however, and earlier this year the Fed began to discuss dialing back its bond purchases. After some jitters this fall, investors seemed to have come to grips with the Fed’s plans. But Mr. Powell’s statements about possibly responding to persistent inflation — which the central bank had long described as “transitory” — with more aggressive tapering amounts to a significant milestone.

“The retiring of ‘transitory’ means we’re also retiring quantitative easing, which has overstayed its welcome,” said Rick Rieder, the head of the global allocation investment team at the money management firm BlackRock in New York.

Without a regular influx of newly created dollars into capital markets, stocks could be in for a rockier run than they’ve seen in more than a year. “Volatility will be higher,” Mr. Rieder said.

An earlier end to the Fed’s bond-buying program would be a tacit signal of an increase in interest rates arriving sooner. Short-term bond yields, which are heavily influenced by expectations for Fed rate hikes, spiked on Tuesday. The yield on the two-year Treasury note rose to 0.56 percent from roughly 0.43 percent in relatively short order, as investors interpreted Mr. Powell’s statements as an acknowledgment that inflation would force the Fed toward favoring higher interest rates. Some of that surge melted away through the afternoon, as the yield on the two-year note ended the day at roughly 0.52 percent.

Stock prices were falling around the world before Mr. Powell’s testimony as investors struggled to understand the danger posed by the Omicron variant, which began roiling markets last week. The Stoxx Europe 600 closed down 0.9 percent; in Asia, the Nikkei 225 in Japan and the Hang Seng in Hong Kong each dropped more than 1.5 percent.

Concerns about potential economic damage from the variant, such as restrictions on travel, hammered crude oil prices again on Tuesday. Futures prices for benchmark American crude tumbled more than 4 percent and were down roughly 20 percent since the start of November.

Taken at face value, such a sell-off implies that investors see growing risks that the Omicron variant sets off a global economic slowdown. But some investors think the prices will likely reverse.

“Is there really a reason for oil be trading down to 66 bucks a barrel when we were up north of $80? Are we literally locking down the entire global economy?” said Jack Janasiewicz, a portfolio manager with Natixis Investment Managers. “It’s an overreaction.”

Investors remain particularly attuned to the effectiveness of vaccines against it. The chief executive of Moderna, a vaccine maker, said in an interview on Tuesday that there could be a “material drop” in the effectiveness of current vaccines to the new variant. The executive, Stéphane Bancel, told The Financial Times that it might be months before an Omicron-specific vaccine could be produced at scale, and he added that it would be risky to shift the company’s entire vaccine production while other variants are still prevalent.

Financial markets have been unsteady since the identification of the Omicron variant in southern Africa late last week. The S&P 500 had its worst day since February on Friday, dropping 2.3 percent. On Monday, it began to recover as politicians around the world cautioned against panic, but Tuesday’s fall more than wiped out those gains.

Despite the swings of recent days, investors continue to sit on solid gains this year. The S&P 500 is up more than 21 percent in 2021 — and that could be reason for the sell-off to worsen next month, as investors try to preserve their gains for the year in the face of growing concerns about what lies ahead.

“You have uncertainty around Covid. You’ve got uncertainty around inflation, uncertainty around global central bank policy,” said Daniel Ivascyn, the group chief investment officer at PIMCO, a large fund manager based in Newport Beach, Calif. “Any one of these things may not be enough to derail the rally, but all of these issues combined with bad year-end liquidity certainly can lead to some significant downside.”

Still, investors say it’s unlikely that the Omicron variant would trigger the same kind of response from governments, business or individuals as the virus did when it first emerged. Even if Omicron is a greater threat than the Delta variant before it, investors expect its effect on the market to be less severe than the nearly 34 percent crash in share prices between February 2020 and the following month.

“The worst case is not March 2020 again,” said Jeb Breece, a principal at Spears Abacus, an independent money management firm in Manhattan. “Fear and unknowns were such a big component of that. I don’t see us doing that again.”

Coral Murphy Marcos contributed to this report.

A sweeping expansion of Twitter’s policy against posting private information was met with backlash shortly after the company announced it on Tuesday, as Twitter users questioned whether the policy would be practical to enforce.

Twitter’s new policy states that photos or videos of private individuals that are posted without their permission will be taken down at their request. Twitter’s rules already prohibit the posting of private information like addresses, phone numbers and medical records.

“When we are notified by individuals depicted, or by an authorized representative, that they did not consent to having their private image or video shared, we will remove it,” Twitter’s new policy states. “This policy is not applicable to media featuring public figures or individuals when media and accompanying tweet text are shared in the public interest or add value to public discourse.”

Twitter is banning posting a photo of any “private individual” without their consent – this strikes me as a bit … unworkable?

I get “don’t post the home address” but “don’t post a photo of a crowd in public” is … odd https://t.co/6uvQOyuDCt

— Matthew Cortland, JD (@mattbc) November 30, 2021

The policy goes further than U.S. law, which allows people to be photographed or filmed in public places. Under Twitter’s policy, people could request that photos of them be taken down even if the images were taken in public.

But Twitter said that its policy is consistent with privacy laws in the European Union and elsewhere and that it had already removed photos of private individuals in those locations, consistent with local laws.

The new policy will extend privacy rights to users in countries that do not have similar laws, a Twitter spokeswoman said. Under Twitter’s policy, a user could have a photo removed if it was used to harass them or if they simply did not like the photo.

Twitter plans to make exceptions for newsworthy images and videos, and the company will take into consideration whether the image was publicly available, was being used by traditional news outlets or was “relevant to the community.”

“We will always try to assess the context in which the content is shared, and, in such cases, we may allow the images or videos to remain on the service,” the policy said.

Video

transcript

transcript

Fed May Withdraw Pandemic Support Early as Inflation Persists

Jerome H. Powell, the Federal Reserve chair, said the Fed would consider ending its bond-buying program earlier than planned due to high inflation pressures, but that it would monitor risks from the new Omicron variant of the coronavirus before making a decision.

-

At this point, the economy is very strong and inflationary pressures are high, and it is therefore appropriate, in my view, to consider wrapping up the taper of our asset purchases, which we actually announced at the November meeting, perhaps a few months sooner. And I expect that we will discuss that at our upcoming meeting in a couple of weeks. Of course, between now and then, we will see another labor market report, another inflation report, and we’ll also get a better sense of the new Covid variant as well before that — before we make that decision. And it’s really about transmissibility. It’s about the ability of the existing vaccines to address any new variant. And it’s about the severity of the disease once it is contracted. And we don’t know — I think we’re going to know — what I’m told by experts is that we’ll know quite a bit about those answers within about a month. We’ll know something, though, within a week or 10 days. And then, then, then and only then, can we make an assessment of what the impact would be on the economy. As I pointed out in my testimony, for now, it’s a risk. It’s not — it’s a risk to the baseline. It’s not really baked into our forecast.

Jerome H. Powell, the Federal Reserve chair, signaled on Tuesday that the central bank is growing more concerned about high — and stubborn — inflation, and could speed up its plan to withdraw economic support as it tries to ensure that rapid price gains do not become long-lasting.

His comments, delivered during a Senate Banking Committee hearing, came at a challenging economic moment for the Fed. Prices for food, shelter and other items are rising quickly, millions of workers have yet to return to the labor market and the virus continues to pose risks to the economic outlook, most recently with the new Omicron variant.

The Fed had been buying $120 billion in government-backed securities each month throughout much of the pandemic to bolster the economy by keeping money flowing in financial markets. In November, officials announced plans to slow those purchases by $15 billion per month, which would have the program ending midway through 2022. But Mr. Powell signaled on Tuesday that the central bank could wrap up its bond-buying more quickly, cutting down the amount of economic juice the Fed will add in upcoming months.

“At this point, the economy is very strong, and inflationary pressures are high,” Mr. Powell said during a hearing before the Senate Banking Committee. “It is therefore appropriate in my view to consider wrapping up the taper of our asset purchases, which we actually announced at our November meeting, perhaps a few months sooner.”

Mr. Powell said he expected Fed officials to discuss slowing bond purchase faster “at our upcoming meeting,” which is scheduled for Dec. 14-15. He stressed that between now and then, policymakers will get a better sense of the new Omicron variant of the coronavirus, a fresh labor market report and updated inflation numbers.

Mr. Powell made it clear that it was too soon for Fed policymakers — or anyone — to tell how much the new variant will affect the economy, since that will hinge on how easily it transmits and whether it causes more severe disease.

“What I’m told by experts is that we’ll know quite a bit about those answers in about a month,” he said. “We’ll know something, though, within a week or 10 days.”

For now, he said, “it’s a risk, it’s a risk to the baseline — it’s not really baked into our forecasts.”

While Omicron’s danger remains uncertain, another virus surge would pose a double-barreled threat to the economy: It could prevent workers from returning to the job market just as it prevents roiled supply chains from returning to normal, keeping a full labor market recovery at bay while making inflation last longer. And the potential threat hits at a fraught moment for policymakers.

The economy has boomed back this year, and hot demand has collided with constrained supply to push inflation sharply higher. The central bank has slowly reoriented its economic policy stance as price gains remain stubbornly elevated, trying to put itself in position to react if needed. Now, the Fed appears to be pivoting more aggressively — and focusing more concertedly on controlling rapid inflation.

“Generally, the higher prices we’re seeing are related to the supply-and-demand imbalances that can be traced directly back to the pandemic and the reopening of the economy, but it’s also the case that price increases have spread much more broadly in the recent few months,” Mr. Powell said Tuesday. “I think the risk of higher inflation has increased.”

Monetary policymakers had spent recent months focused on helping the economy to heal, hoping to pull the millions of workers still missing from the job market back into work.

The Fed’s policy interest rate, its more traditional and more powerful tool, has remained set to near zero to that end. Officials had been stressing that they would be patient in pulling back that support and cooling down the economy, giving missing employees more time to return.

But their tone appears to be shifting.

Slowing bond purchases quickly would put officials in a position to raise borrowing costs sooner than previously forecast. Lifting interest rates earlier or faster would pump the economic brakes, helping to slow home-building, business expansions and consumer spending. Weakening demand would in turn help to weigh down prices over time.

By trying to rein in price increases, the Fed would probably slow hiring. Doing so could be painful at a moment when people remain out of work partly out of virus fears or a lack of child care.

That’s why Omicron could pose such a big challenge. If the new variant continues to shut down factories and slow shipping routes while keeping would-be job applicants at home, it could put the Fed in a tough spot. Central bank policymakers are supposed to foster both full employment and keep prices stable, and such a situation would force them to choose between those goals.

Mr. Powell’s willingness to to pull back support faster despite the new variant — and his full-throated recognition that price gains are not poised to be as short-lived as officials had once hoped — caught investors’ attention.

At one point, Mr. Powell even said that at “coming meetings” he expected the Fed’s policy-setting committee would say that when it comes to inflation, its standard for lifting interest rates had been met. That would mean that central bankers would simply be looking to the job market as they weighed when, whether and how much to raise borrowing costs.

“The tone of his remarks was notably hawkish, suggesting that the Fed’s primary focus is on the risk of more persistent excess inflation,” Krishna Guha, an economist at Evercore ISI, wrote in a research note reacting to the testimony.

Stocks, which had been down roughly 0.5 percent for much of the morning, tumbled after Mr. Powell’s comments, with the S&P 500 trading down about 1.9 percent shortly after noon. Short-term bond yields, which are heavily influenced by expectations for Fed rate hikes, spiked as investors began to expect what is sometimes referred to as a “hawkish” approach to interest rate policy.

“The Fed is the ultimate owner of the ‘transitory’ characterization, and the chair’s decision to move beyond that is a decidedly hawkish step,” wrote Ian Lyngen, head of U.S. rates strategy at BMO Capital Markets in New York, in a note to clients shortly after Mr. Powell’s comments.

The shift in the Fed’s policy approach comes at a sensitive moment for Mr. Powell. The Biden administration announced last week that it will renominate him as chair of the Fed, and that it will elevate Lael Brainard — now a governor — as the central bank’s vice chair. Both await Senate confirmation.

The twin threats of lasting supply chain disruptions and another pandemic flare also come as Republicans are trying to pin high inflation on the Biden administration and its policies. Several Republican senators asked combative questions of Mr. Powell and Treasury Secretary Janet L. Yellen during their joint testimony on Tuesday, at times trying to back them into blaming rapidly rising prices on Mr. Biden’s policies.

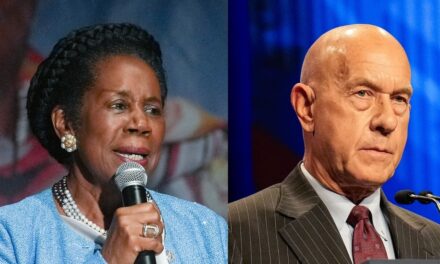

Image

The barrage of criticism came as Democrats are working to pass another $2.2 trillion climate change and social policy bill before the end of the year.

Ms. Yellen defended the Biden administration’s economic agenda, insisting that the policies are fiscally responsible and that they would reduce costs for families at a time when prices are rising.

“The Build Back Better plan contains support for households to help address some of the most burdensome and most rapidly rising costs that they face,” Ms. Yellen said, pointing to proposals to make preschool free, provide expanded care for the elderly and increase education subsidies.

Republicans, who four years ago passed $1.5 trillion in tax cuts that went mostly to the rich, assailed the spending proposals as reckless. Ms. Yellen insisted that tax increases and an investment in the Internal Revenue Service to ensure that people and companies are paying the taxes they owe would prevent the legislation from adding to the debt.

“It is fully paid for, or even more than fully paid for,” Ms. Yellen said.

Others criticized the administration and Fed’s response to the virus and the risks it poses.

“At what point do we just get back to a more normal execution of Fed policy?” Thom Tillis, a Republican Senator from North Carolina, asked Mr. Powell, after stating that the virus is likely to remain present.

“We have to be humble about our ability to predict this, or really understand,” Mr. Powell replied, after saying that the central bank does not expect the new variant to have fallout that is “remotely comparable” to the initial pandemic-spurred state and local lockdowns.

Matt Phillips contributed reporting.

Image

WASHINGTON — Treasury Secretary Janet L. Yellen said on Tuesday that she still supported an embattled proposal that would require banks to turn over additional information about their customers’ accounts to the Internal Revenue Service, arguing that the proposal would help ensure that the wealthy were not dodging taxes.

The bank reporting idea had been central to the Biden administration’s plan to shrink the $7 trillion “tax gap” — the shortfall in taxes that are owed but not collected — and help pay for the $2.2 trillion social policy and climate legislation that Democrats are trying to pass this year. After fierce backlash from banks and Republicans, who derided the idea as an invasion of privacy, it was dropped from the bill that House Democrats passed this month.

The Biden administration has been hoping that a more modest version of the proposal could make it into the Senate’s version of the bill. Ms. Yellen said she still backed the concept of having banks share data for accounts with total annual deposits or withdrawals of more than $10,000, with exceptions for wage earners or people who receive federal benefits like Social Security.

“I do support it,” Ms. Yellen said at a Senate Banking Committee hearing. “I think it’s important that the I.R.S. have visibility into opaque income streams and that’s an important way of improving tax compliance.”

Republicans insisted that the I.R.S. could not be trusted with additional data because of recent leaks of taxpayer information and the agency’s history of targeting political groups.

“Certainly my constituents can’t condone this aspect of the Build Back Better plan that would give even more authority and a tenfold increase in the budget to snoop on more Americans, audit more Americans and invade our privacy,” Senator Bill Hagerty, Republican of Tennessee, said.

Ms. Yellen said the plan was not an attempt to “snoop” on taxpayers or collect detailed information about their banking activity.

“The burden on financial institutions was minimal, and there was no attempt to target income earners whose actual incomes are below $400,000,” Ms. Yellen said.

Although the chances of the bank reporting requirement’s making it into the final legislation appear slim, Democrats are counting on an investment of $80 billion to expand the enforcement capacity of the I.R.S. to generate $400 billion of additional tax revenue over a decade. That estimate, which is more optimistic than the projections of the Congressional Budget Office, allows the Biden administration to claim that the new spending will not add to the national debt.

“These are very important resources that are needed to make sure that the wealthiest individuals, and corporations particularly, comply with the tax laws and pay their fair share, what’s due,” Ms. Yellen said.

Image

David Marcus, the leader of cryptocurrency efforts at Meta, the company formerly known as Facebook, said on Tuesday that he plans to leave his post at the end of the year.

Mr. Marcus, 48, a longtime Silicon Valley executive in payments and digital finance, worked on many projects during his seven years at the social media company. Most recently, he spearheaded Meta’s push into a global digital currency that could be used by Facebook and WhatsApp users to transmit payments across borders. The project, initially called Libra, was later rebranded Diem after facing pushback from regulators.

“I remain as passionate as ever about the need for change in our payments and financial systems,” Mr. Marcus said in a series of tweets. “My entrepreneurial DNA has been nudging me for too many mornings in a row to continue ignoring it.”

Mr. Marcus founded Zong, a mobile payments start-up that was acquired by the digital finance giant PayPal. After rising quickly at PayPal, he was recruited to Facebook to lead its Messenger app, growing it to reach hundreds of millions of users.

While at Facebook, Mr. Marcus was heavily involved in the rise of Bitcoin and other cryptocurrencies, acting as an adviser to companies like Coinbase.

He parlayed that knowledge into Libra, which was a pet project of Mark Zuckerberg, Meta’s chief executive. Libra was an attempt to democratize finance so that people could use Facebook’s apps — including Messenger and WhatsApp — to send cryptocurrency to one another across the world, which they could eventually exchange for local currencies.

The project stalled when a bipartisan coalition of lawmakers questioned the company’s efforts and how much power the social network had over global social media. Mr. Marcus testified about the efforts to Congress in 2019, though it did little to assuage concerns.

The Libra cryptocurrency was eventually rebranded Diem, while the company’s efforts at a crypto wallet were called Novi. The mishmash of names often has been confusing, even for company insiders.

Mr. Marcus did not specify his future plans. Spokespeople for Meta did not immediately respond to a request for comment.

Image

Inflation soared to a record high in Europe in November as a continued climb in energy costs pushed prices skyward, data showed on Tuesday.

Annual inflation in the eurozone surged to 4.9 percent, the European statistics agency Eurostat reported, the highest since records began in 1997. Excluding volatile energy and food prices, inflation jumped 2.6 percent from a year earlier, the highest in two decades.

Prices for goods and services have been climbing steadily since summer as a reopening of the global economy from coronavirus lockdowns juiced economic activity, sending energy costs up and crimping global supply chains.

Energy costs jumped 27.4 percent in November from a year earlier, continuing an upward trend.

“We haven’t seen inflation this high since the eighties,” Bert Colijn, senior economist for the eurozone at ING Bank, said in a note to clients. “The energy shock of 2021 is starting to have a substantial impact on consumers,” he added.

Year-over-year inflation in the eurozone

The inflation gains have driven up costs for a range of products and services, and have led workers and unions to demand higher wages in many European countries.

Germany, Europe’s largest economy, reported that inflation accelerated to 6 percent from a year earlier, while in France it rose to 3.4 percent, the highest in over a decade. The highest rates were in Belgium, 7.1 percent, and in Lithuania, topping 9 percent.

With the rapid circulation of the recently discovered Omicron variant of the coronavirus, the global economic outlook has suddenly grown more uncertain.

The European Central Bank has said it expects the inflation spike to be temporary as energy price increases fade next year. The bank’s mandate is to keep inflation to a 2 percent target.

“Although the E.C.B. has stated that it sees the current price pressures easing in 2022, and our baseline is that monetary policy will remain accommodative, the latest data will add to the debate on the appropriate level of policy support,” Katharina Koenz, an economist at Oxford Economics, said in a note to clients.

“However,” she added, “there isn’t much the E.C.B. can do about higher energy prices and supply bottlenecks in the short term anyway.”

Image

The athletic apparel retailer Lululemon filed a lawsuit against the fitness company Peloton on Monday, accusing it of patent infringement over the designs of a new line of leggings and sports bras.

The lawsuit, filed in U.S. District Court for the Central District of California, accuses Peloton of trade dress infringement, false designation of origin and unfair competition. Lululemon is seeking an injunction against Peloton as well as a jury trial, damages and other monetary relief.

Peloton and Lululemon ended a co-branding relationship this year, a split that Peloton described as amicable, according to court documents. Peloton introduced a new apparel brand in September.

In its suit, Lululemon said that five Peloton-branded women’s bra and legging products, including the Strappy Bra, the Cadent Laser Dot Bra and the Cadent Laser Dot Legging, “were infringing” on six Lululemon patents.

Lululemon also claimed that a Peloton product labeled One Luxe Tight was an imitation of one of Lululemon’s best sellers, the Align Pant.

Peloton declined to comment on the lawsuit on Tuesday.

Shannon Higginson, senior vice president, general counsel and chief compliance officer at Lululemon, said in a statement that the company was “confident in our position and look forward to properly resolving this case through the courts.”

“Unlike innovators such as Lululemon, Peloton did not spend the time, effort and expense to create an original product line,” Lululemon said in its complaint. “Instead, Peloton imitated several of Lululemon’s innovative designs and sold knockoffs of Lululemon’s products, claiming them as its own.”

The suit is the latest escalation in a dispute between the two popular brands. On Nov. 24, Peloton filed a complaint in U.S. District Court for the Southern District of New York, asking for a court declaration that it had not infringed on any of Lululemon’s patents.

Peloton said in its complaint that its merchandise “has clear and obvious differences that allow the products to be easily distinguished” from Lululemon’s products.

On Nov. 11, lawyers for Lululemon sent a cease-and-desist letter to Peloton saying that the company would sue unless Peloton stopped selling “copy-cat products” that infringed on Lululemon’s “design patent and trade dress rights.”

In its complaint, Peloton said that Lululemon’s “allegations lack any merit,” adding that the companies’ “brands and logos are also distinctive and well-recognized, making confusion between products a virtual impossibility.”

Image

British antitrust regulators on Tuesday ordered Facebook’s parent company, Meta, to sell the animated images library Giphy, escalating the country’s efforts to push back against the growing power of the world’s largest technology companies.

The Competition and Markets Authority said the acquisition of Giphy, which Meta bought last year, reduced competition between social media platforms and in the display advertising market, which Facebook dominates and where Giphy was beginning to expand before the deal.

Though the animated images, known as GIFs, are often silly clips and memes shared in text messages and social media posts — like Homer Simpson slinking back into a hedge — authorities concluded that Meta’s acquisition could cause serious harm to competition. Giphy is a dominant platform for creating and sharing GIFs, and regulators warned that if Meta restricted access to its vast archive of images it would further solidify Meta’s leadership position in social media.

Meta’s services, including Facebook, WhatsApp and Instagram, account for 73 percent of user time spent on social media in Britain, regulators said. The overall company was known as Facebook until a name change in October.

The Competition and Markets Authority said its order was legally binding and should result in Meta’s selling all of Giphy, not just the piece of its business in Britain.

Meta’s ownership of Giphy allows the company “to increase its significant market power in social media even further, through controlling competitors’ access to Giphy GIFs,” Stuart McIntosh, chair of the team investigating the deal, said in a statement. By ordering the sale, “we are protecting millions of social media users and promoting competition and innovation in digital advertising.”

In October, British antitrust regulators fined Meta 50.5 million pounds, or nearly $70 million, for “consciously refusing” to report all required information related to the Giphy investigation.

On Tuesday, Meta said it was reviewing the order to sell Giphy. It has four weeks to decide whether to appeal.

“We disagree with this decision,” the company said in a statement. “We are reviewing the decision and considering all options, including appeal. Both consumers and Giphy are better off with the support of our infrastructure, talent and resources.”

The effort to reverse the Giphy acquisition is another step Britain is taking against the biggest tech companies. British policymakers are drafting tougher competition laws, including the appointment of a new technology industry regulator, to prevent companies like Meta from consolidating power.

A new online safety law that is being debated would require Meta and other internet platforms to do more to block illicit content.

In the United States, Meta is battling claims brought by the Federal Trade Commission and several states that it bought up smaller rivals to illegally undermine competition.

Image

Thousands of pages of new evidence and sworn testimony released on Monday show the extent to which former Gov. Andrew M. Cuomo relied on a group of allies, including his younger brother, the CNN host Chris Cuomo, to strategize how to deflect and survive a cascade of sexual harassment charges that eventually engulfed him.

Chris Cuomo pressed to take on a greater role in crafting his brother’s defense, including phoning into strategy calls and using his media contacts to keep tabs on reporters pursuing stories about the governor. At one point, he even ran down a secondhand tip that another woman accusing the governor of unwanted advances at a wedding was lying. (She was not.)

“You need to trust me,” Chris Cuomo pleaded with Melissa DeRosa, the governor’s secretary, at one point in March, arguing that she should rely on him and other outside advisers like the political consultant Lis Smith and the pollster Jefrey Pollock.

He added: “We are making mistakes we can’t afford.”

CNN said on Monday that the investigative documents “deserve a thorough review and consideration.”

“We will be having conversations and seeking additional clarity about their significance as they relate to CNN over the next several days,” the company said in a statement.

When Ms. DeRosa was trying to keep tabs in early March on journalists working to uncover stories of harassment, she turned to Chris Cuomo for “intel.”

“On it,” he wrote back after one such request. A few days later, Ms. DeRosa wrote to the governor’s brother that she had heard Ronan Farrow of The New Yorker was “getting ready to move” a story. “Can u check your sources?”

In text messages with Ms. DeRosa in March, Chris Cuomo said he was in a “panic” about how the governor’s team was handling the accusations and pleaded to “let me help with the prep” before drafting his own proposed statements for the governor to read, including one referencing “cancel culture.”

The newly released records included copies of text and email messages, as well as transcripts of depositions with many of Governor Cuomo’s closest aides. READ THE ARTICLE →

Image

-

Taking a deep breath, Elizabeth Holmes briefly crumpled her face as she spoke, her voice breaking.

Ramesh Balwani, her former boyfriend and business partner, emotionally and physically abused her, Ms. Holmes testified in court on Monday. He was controlling, she said, prescribing the food she ate, dictating every minute of her schedule and keeping her away from her family. And he forced her to have sex with him against her will, she said.

“He would force me to have sex with him when I didn’t want to because he would say that he wanted me to know he still loved me,” Ms. Holmes said on the stand, while crying.

It was the most dramatic moment in a three-month trial, with Ms. Holmes accused of lying and faking her way into hundreds of millions of dollars for her failed blood testing start-up, Theranos. READ MORE →

-

A regional office of the National Labor Relations Board on Monday ordered a new union election at an Amazon warehouse in Alabama, upholding a union challenge to a vote that the company won decisively.

The decision was widely expected after a hearing officer recommended in August that the results be thrown out and that a new election take place. The company declared after the August decision that it intended to appeal to the labor board in Washington if it did not prevail at the regional level, but it did not say Monday whether it would follow through.

The union filed a formal objection to the election shortly after the results were announced in April, arguing that Amazon had undermined the conditions for a fair election by pressing the Postal Service to install a collection box at the warehouse, among other complaints. The union said the box, which was not authorized by the labor board, created the impression that Amazon was monitoring which workers voted.

In her decision Monday, the labor board’s regional director for the Atlanta region agreed, writing that Amazon “gave a strong impression that it controlled the process” by arranging the installation of the box. “This dangerous and improper message to employees destroys trust in the board’s processes and in the credibility of the election results,” the director, Lisa Y. Henderson, concluded. READ MORE →

Source: https://www.nytimes.com/live/2021/11/30/business/news-business-stock-market